The SEC has accused Kraken of operating as an unregistered exchange, broker, dealer, and clearing agency, and of commingling customer assets with its own.

U.S. authorities have taken legal action against Kraken, a major cryptocurrency exchange, alleging that it has violated securities laws. The Securities and Exchange Commission (SEC) filed a complaint on November 20, accusing Kraken of combining customer funds and failing to register as a securities exchange, broker, dealer, and clearing agency. The SEC claims that Kraken has been illegally facilitating cryptocurrency transactions since 2018. Kraken has strongly denied the SEC's allegations and intends to defend itself vigorously in court. This lawsuit is the SEC's latest attempt to assert its control over the cryptocurrency industry. SEC Chairman Gary Gensler has unequivocally stated that the agency considers cryptocurrencies to be securities contracts under U.S. law.

"Kraken has operated as an unregistered broker, dealer, exchange, and clearing agency for crypto asset securities."

Moreover, the SEC asserted that Kraken's business practices and inadequate internal controls led to the mingling of up to $33 billion in customer assets with the exchange's own funds. According to the SEC, this created a substantial risk of loss for Kraken's clients. The complaint alleged that Kraken used accounts containing customer assets to directly cover operational expenses, as confirmed by the exchange's independent auditor. SEC Enforcement Division Director Gurbir Grewal stated, "We contend that Kraken opted to profit from investors to the tune of hundreds of millions of dollars rather than aligning with securities laws. This decision resulted in a business model fraught with conflicts of interest, jeopardizing investors' funds." Kraken countered the SEC's accusations, with a spokesperson asserting that the exchange never listed unregistered securities.

"We refute the SEC's complaint against Kraken, maintain our stance that we do not list securities, and intend to robustly defend our position."

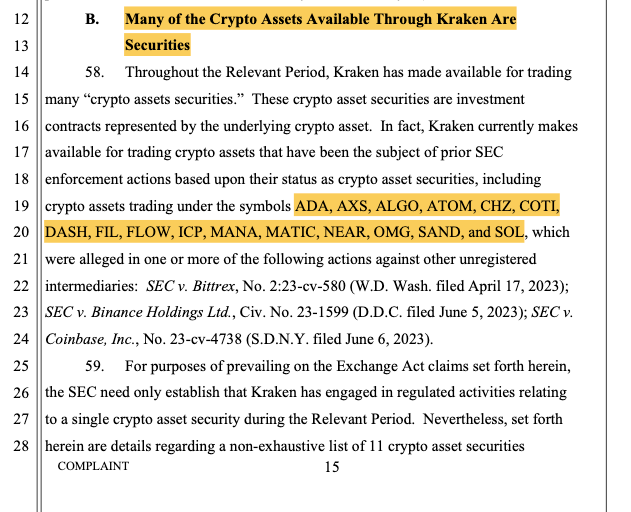

"The spokesperson expressed disappointment in the SEC's continued approach of regulation through enforcement, emphasizing its adverse effects on American consumers, innovation stifling, and damage to U.S. competitiveness on a global scale." "In a subsequent blog post on November 20, Kraken asserted that the SEC's allegations of commingling were merely the exchange using fees it had already earned and clarified that the regulator did not assert any missing user funds." "The SEC's complaint identified 16 cryptocurrencies, including ADA (Cardano) down to $0.361, ALGO (Algorand) down to $0.13, MATIC (Polygon) down to $0.7373, and SOL (Solana) down to $53, categorizing them as securities."

The SEC’s complaint against Kraken listed 16 cryptocurrencies as securities. Source: CourtListener

The SEC's complaint contends that Kraken breached the registration provisions outlined in the Securities Exchange Act of 1934. The regulatory body is seeking penalties and injunctive relief from Kraken, along with the demand for the exchange to return its "ill-gotten gains." The allegations accusing Kraken of functioning as an unregistered broker for cryptocurrency assets mirror similar claims made against Coinbase and Binance in separate lawsuits filed in June. On February 9, Kraken reached a settlement of $30 million with the regulator, agreeing to discontinue the offering of crypto staking products and services to U.S. customers.